This course introduces students to quantitative trading. A trader usually starts with an intuition or a vague trading idea. Using mathematics, s/he turns the intuition into a quantitative trading model for analysis, back testing and refinement. When the quantitative trading model proves to be likely profitable after passing rigorous statistical tests, the trader implements the model on a computer system for automatic execution. In short, quantitative trading is the process where ideas are turned into mathematical models and then coded into computer programs for systematic trading. It is a science where mathematics and computer science meet. In this course, students study trading strategies from popular academic literature and learn the fundamental mathematics and IT aspects of this emerging field. By working on the class projects, they will gain hands-on experience. After satisfactorily completing this course, the students will have the necessary quantitative, computing, and programming skills in quantitative trading. They are therefore well prepared for a front office role in hedge funds or banks.

This course covers some popular trading strategies such as technical analysis, trend following, mean reversion, factor model, portfolio optimization as well as risk management. We examine these strategies from the perspective of quantitative mathematics. This course has been taught in many universities and organizations including National University of Singapore, Nanyang Technological University, Hong Kong University of Science and Technology and Fudan University.

Outline

| Lesson 1 | Technical Analysis: A Scientific Perspective |

| Lesson 2 | Hidden Markov Trading Model |

| Lesson 3 | Trend Following |

| Lesson 4 | Pairs Trading by Cointegration |

| Lesson 5 | Optimal Pairs Trading by Stochastic Control |

| Lesson 6 | Pairs Trading by Stochastic Spread Methods |

| Lesson 7 | Small Mean Reverting Portfolio |

| Lesson 8 | Performance Measures |

| Lesson 9 | Quantitative Equity Portfolio Management |

| Lesson 10 | Risk Management |

Textbook

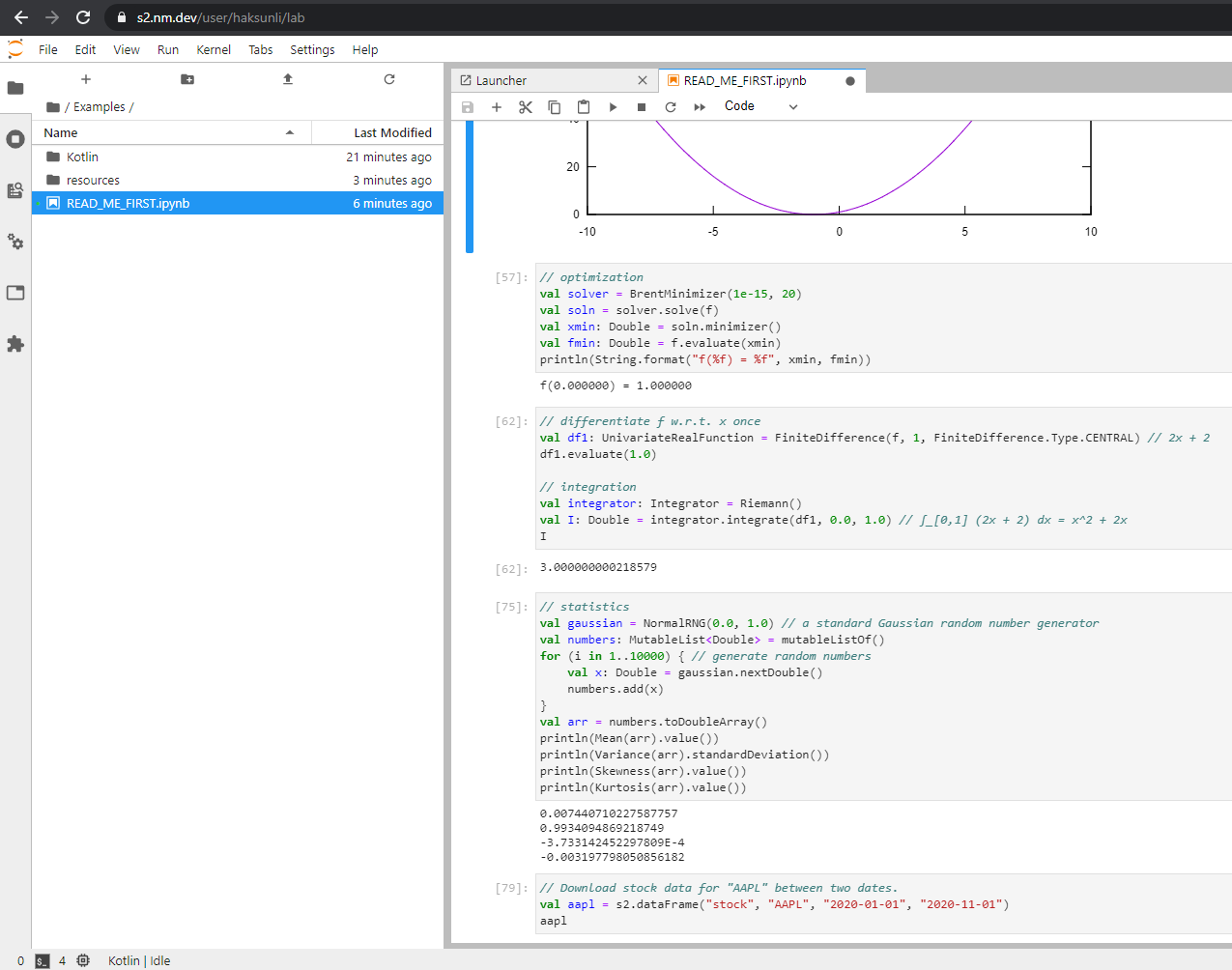

Numerical Methods in Quantitative Trading, by Dr. Haksun Li, Dr. Waipun Ken Yiu, Dr. Kevin Haoyu Sun

Instructor

Prof. Haksun Li is a co-founder of NM LTD., NM FinTech LTD., NM Optim LTD. and Atomus Asset Management.

The group of NM companies has the single mission of “Making the World Better using Mathematics”. Under his leadership, the company group serves security houses, hedge funds, high-net-worth individuals, multinational corporations, factories and plants all over the world.

NM LTD. is dedicated to the research and development of innovative computing technologies for business operations as well as quantitative wealth management. Using state-of-the-art computer science, Haksun has developed a suite of programming libraries of fundamental and advanced mathematics. The suite has made the otherwise very-hard-to-understand and inaccessible mathematical theories at the fingertip of business users.

NM Optim LTD helps factories and plants to streamline operations, improve productivity and increase revenue by applying operations research and optimization theories. It is the bridge between industries and academia. Haksun leads a team to revolutionize the workflow of factories by making more efficient use of resources, better scheduling, better management, better pricing, etc., all based on mathematical models, bringing companies to Industry 4.0.

NM FinTech LTD. develops financial analytic systems for quantitative portfolio managers worldwide. For the U.S. equity market, Haksun created a Risk Management System, together with a factor library and tools for portfolio construction. For the China bond market, Haksun created SuperCurve which is the only accurate yield curve publicly available for pricing Chinese bonds, together with a suite of fixed income analytics.

Atomus Asset Management is a hedge fund in Shanghai, China. Haksun leads the research team to use advanced technologies, such as AI and Big Data, to develop quantitative trading strategies. The fund has achieved excellent stable investment performance.

Haksun is the associate dean and a professor of the Big Data Finance and Investment Institute of Fudan University, China. Prior to that, Haksun was a quantitative analyst and a quantitative trader at UBS and BNP Paribas.

Haksun holds a bachelor’s degree in mathematics and a master’s degree in financial mathematics from the University of Chicago, as well as a master’s and a doctoral degree in computer science and engineering (with specialization in A.I.) from the University of Michigan, Ann Arbor.